Portfolio Deductions Not Subject To 2 Floor

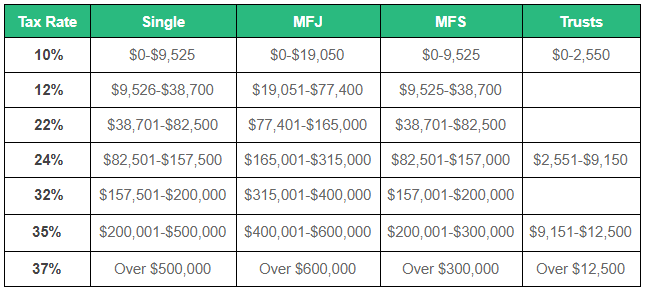

Prior to 2018 line 13k was used for deductions portfolio 2 floor which represented a taxpayer s share of portfolio deductions that are subject to the 2 income limitation as a miscellaneous deduction on schedule a form 1040.

Portfolio deductions not subject to 2 floor. Deductions portfolio formerly deductible by individuals under section 67 subject to 2 agi floor. Shall prescribe regulations which prohibit the indirect deduction through pass thru entities of amounts which are not allowable as a deduction if paid or incurred directly by an individual and which contain such reporting requirements as may be. The tcja eliminated all of these subject to 2 expenses for tax years through 2025 some deductions do remain. Unreimbursed employee business expenses such as.

In prior years amounts subject to the 2 floor on line 13 of sch k 1 would have been coded with a k. Deductible expenses subject to the 2 floor includes. You must report the full amount of your winnings as income and claim your losses up to the amount of winnings as an itemized deduction. Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

Thus you should not need to make additional entries as other current year decreases. This publication covers the following topics. For taxpayers other than individuals deduct amounts that are clearly and directly allocable to portfolio income other than investment interest expense and section 212 expenses from a remic. These losses are not subject to the 2 limit on miscellaneous itemized deductions.

Deductions portfolio formerly deductible by individuals under section 67 subject to 2 agi floor. This code has been deleted. 2 percent floor on. Starting on january 1 2018 and running through december 31 2026 individuals will no longer have the ability to deduct the excess expenses listed below as itemized deductions on their 1040s.

You cannot simply reduce your gambling winnings by your gambling losses and report the difference. These miscellaneous deductions subject to the 2 income limitation were eliminated by the tax cuts and jobs act. You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr. For partners other than individuals amounts that are clearly and directly allocable to portfolio income other than investment interest expense and section 212 expenses from a remic can be deducted on those partners income tax returns.

These porfolio deductions are not subject to the 2 floor. Expenses for uniforms and special clothing.